People's Choice Award Voting

Vote for your favorite here! Voting opens at 3:10pm CDT.

Vote for your favorite here! Voting opens at 3:10pm CDT.

Cindy is an affiliate at ARCH Venture Partners. She focuses on life science businesses and is a cofounder of several ARCH portfolio companies, including deCODE genetics, an Icelandic diagnostics company; Adolor, a pharmaceutical firm developing novel analgesics; and Elixir Pharmaceuticals, an anti-aging and metabolic disease company. Cindy has worked with ARCH since 1992 and has been instrumental in sourcing companies like Alnylam Pharmaceuticals and Agios Pharmaceuticals. She has also participated in the planning and diligence for many other companies in the portfolio. Early in her career, she was a general field engineer with Schlumberger Offshore Services. She holds a BS in physics from the University of Rochester and an MBA and PhD in virology from the University of Chicago.

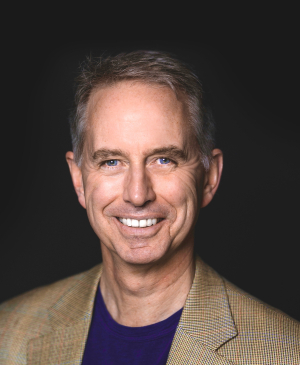

Dan Caruso is Managing Director of Caruso Ventures, a 3x decacorn entrepreneur and an avid supporter of entrepreneurship.

In 2020, Dan and Cindy Caruso founded Caruso Ventures, which represents their investment portfolio, family office, and not-for-profit activities. Most of Caruso Ventures’ direct investments are in support of the Colorado ecosystem. Current investments include Exum Instruments, BillGO, Genalyte, Canopy Aerospace, Kuleana Rum Works, ALLCITY, Radia, Boom Supersonic, Guest House, Tovala, Language I/O, Outside Interactive, Voyager Space Holdings, Honest Jobs, Maybell Quantum Industries, VUZ, Arryved, Atom Computing, Infleqtion, Codigo Tequila, Mindful Care, Pippin Title, Ninja Nation, Firefly, Resonance, Chamba, Agile Space Industries, Toters and Zayo Group. Exited investments include euNetworks, Bolder Surgical, Envysion, GTS Central Europe, and Galvanize.

Dan was the Founding Partner, Chairman and CEO of Zayo Group Holdings, Inc. (NYSE: ZAYO), where investors enjoyed a $8.5B equity exit on a $1.0B investment. Dan was a co-founding executive of Level 3 and joined Metropolitan Fiber Systems (MFS) as it began to scale. All three exited for enterprise values > $10B. Dan also led the take private of ICG, which achieved a 25X return and led to the ideation of Zayo.

Dan is a supporter of Colorado’s and Chicago’s entrepreneurial community, and is particularly interested in the intersection between tech scaleups and inclusion. He serves as Chairman of the Board for Endeavor Colorado and is on the boards of Elevate Quantum and Colorado Thrives. Dan was the original Steering Committee Chairman of Colorado’s Blackstone Entrepreneurs Network.

In 2015, Dan and Cindy established The Caruso Foundation to Support Initiatives that Inspire Entrepreneurship, Innovation, and Inclusion. The Caruso Foundation supports a number of impactful organizations including University of Chicago’s New Venture Challenge, University of Colorado Boulder’s Startup Summer, Catalyze CU, and New Venture Challenge, Greenhouse Scholars, Endeavor Colorado, Colorado Thrives, CiviCO, Access Opportunity, and EforAll.

Dan is a recipient of several awards including the Chicago Booth Distinguished Alumni Award for Entrepreneurship, University of Illinois Alumni Award for Distinguished Service, Colorado Technology Association’s Bob Newman Lifetime Achievement Award, University of Colorado Leeds Corporate Partner Award (Zayo), and Colorado Governor’s Corporate Citizenship Medal.

Dan gave the commencement address for the University of Illinois Grainger College of Engineering (2019) and the University of Colorado Boulder MBA (2020).

Dan holds an MBA from the University of Chicago and a B.S. in Mechanical Engineering from the University of Illinois.

Joanne is a partner at Foundation Capital where she works with gritty entrepreneurs who build and leverage proprietary data assets to disrupt business functions. She studies the impact of AI, and invests in AI-first B2B applications and data platforms that are the building blocks of the automated enterprise. Joanne’s passion for technology developed early, when her mathematician dad and computer scientist mom taught her how to program. By the time she was nine years old, she had turned her skills into a business and made her first webpage for a client. Joanne began her career as an engineer at Cisco Systems and later cofounded a mobile gaming company. She also spent many years working on Wall Street at Jefferies & Company, helping tech companies go through the IPO and M&A processes, and at Probitas Partners, advising venture firms on their own fundraising process. She was an angel investor for two years at Hyde Park Angels prior to joining Foundation in 2014. Joanne is on the board of TubiTV and Findera, and observes the boards of Mya Systems, Custora, and Localytics. She has also invested in Simppler, Quilt Data, Brightback, Oasis Labs, CaptivateIQ, and Zengaming. Joanne has a bachelor’s degree in science from the University of California at Berkeley and an MBA from Chicago Booth.

Jake Crampton is the founder and CEO of MedSpeed, the market-leading provider of same-day transportation services to the healthcare industry. Under Jake’s leadership, MedSpeed has grown from a Chicago-based startup to a national enterprise with over 140 operations across 29 states and a client base that includes one-quarter of the top 100 health systems in the country. Jake and his classmates created the concept for MedSpeed at Chicago Booth as the final project for Professor James Schrager’s New Venture Strategy course which they further developed as a participant in the second annual Edward L. Kaplan, ’71, New Venture Challenge. After winning the competition, Jake changed his postgraduation plans to focus on launching MedSpeed.

An entrepreneur by nature, Jake founded and nurtured a successful language-training business in Mexico City prior to launching MedSpeed. Jake was named Entrepreneur of the Year Midwest by EY in 2017 and received the Chicago Booth Entrepreneurial Distinguished Alumni Award in 2021. Jake earned his bachelor’s degree from the University of Illinois and an MBA in entrepreneurship from Chicago Booth.

Sara Crown Star is a Venture Partner with FemHealth Ventures, a firm focused on advancing innovations in women’s health. FemHealth invests in drugs, devices, digital applications and diagnostics. Sara was a director of Thinx, a FemTech company she backed and advised from its early stages, which was sold to Kimberly Clark in 2022. She is a life trustee of Erikson Institute and a director of 1871, Musicians on Call, Jewish United Fund of Metropolitan Chicago, and the Covenant, Ortus, and Crown Family Foundations.

Earlier in her career, Sara practiced law in New York City and Chicago. She also served as a trustee, governor, or director on multiple boards including, Crown Family Philanthropies, Craniofacial Center at the University of Illinois, Latin School of Chicago, and Hebrew Union College. In addition, Sara launched the Business Law Scholars certificate track at Georgetown Law, the Star Fellows Cantorial program at Hebrew Union College, and the Bazelon Fellowship at the Bazelon Center for Mental Health Law in Washington, D.C.

Sara has a B.S. from the University of North Carolina at Chapel Hill, a J.D. from Georgetown University Law Center, an Executive MBA from Northwestern University’s Kellogg School of Management, and graduated from the Wexner Heritage Program. In addition, she received the Paul R. Dean Alumni Award from Georgetown University Law Center, the Spirit of Erikson Award from the Erikson Institute, and the Shofar Award from Chicago’s Jewish United Fund.

Sara was the 2013 Runner Up in the Giordano’s Dancing with the Stars competition and has co-produced two Off-Broadway shows.

Jai Das is a managing director, president, and cofounder at Sapphire Ventures. He invests in startups which he believes are developing ground-breaking products and services, and have embarked on their journey to become a company of consequence. Das has more than 15 years of experience helping companies innovate their product and marketing strategies in order to scale and become market leaders. Eleven of his investments have become publicly traded companies including Alteryx, Box, Five9, Square, and Nutanix as well as nine of his investments have been acquired including Apigee (Google), CloudHealth (VMware), ExactTarget (Salesforce), and MuleSoft (Salesforce). Das is currently a member of the board (director or observer) at AllyO, Catchpoint, Clari, DataRobot, JFrog, Narrative Science, OpsRamp, Portworx, PubNub, Punchh, Splashtop, Sumo Logic, and ThoughtSpot. Prior to joining Sapphire Ventures in 2006, Das worked at Oracle, Intel Capital, Agilent Ventures, and MVC Capital. He earned a bachelor’s in electrical engineering from Brown University and an MBA from Chicago Booth, where he was awarded the George Hay Brown Prize for academic excellence.

Laura Desmond is the CEO at Smartly, an AI-powered advertising technology company, transforming ad experiences for brands and their consumers.

Prior to Smartly, Desmond was Chief Revenue Officer of Publicis Groupe and Chief Executive Officer of Starcom Mediavest Group, the #1 media and marketing services agency brand globally for five straight years under her leadership. Desmond has worked with some of the biggest and most successful marketers worldwide, including Samsung, Spotify, Coca-Cola, Visa, Bank of America, and P&G.

During her career in Advertising, Desmond has been awarded many honors including: AAF Hall of Achievement, Ad Age “Women to Watch”, WSJ Top 50 Most Powerful Women in Business, Fortune’s Most Powerful Women and Chairwoman of the Advertising Council. Today, Laura serves on the boards of Adobe, DoubleVerify, as well as Smartly.

Additionally, Desmond is a champion of the advancement of women’s sports serving as an early investor in Chicago women’s sports franchises, including the Chicago Sky and the Chicago Red Stars.

Jim has over 20 years of corporate finance, capital markets, and venture capital experience. He serves on the boards of EdMap, TradeKing, Cleversafe, TDJM, Javlin Capital, SumRidge Partners, Campus Explorer, Apparel Media Group (CustomInk), Automated Insights, Pangea, Falcon Insurance Group, Solovis, Chicagoland Entrepreneurial Center, 1871, IIT, and NU Wave. Prior to cofounding OCA Ventures, Jim oversaw the OCA Ventures pledge fund, which made direct investments for the O’Connor Partners Investment Office. He also traded derivatives at the Chicago Board of Trade and worked in corporate finance with Continental Bank. Jim is a founding member of the Illinois Venture Capital Association, where he has served as treasurer, director, member of the executive committee, and chairman of the legislative committee, helping to establish HB 3212 as Illinois law. Jim received his bachelor’s degree from the University of Rochester and an MBA from Northwestern University.

Jim Frank spent his entire business career leading Wheels, Inc, a business wholly owned by the Frank Family, where he was CEO from 1975 until becoming Executive Chair in 2017. Jim’s son, Dan, was CEO from 2017 until October of 2021 when the business was sold to Athene Insurance, a subsidiary of Apollo. Wheels founded the Vehicle Fleet Management and Leasing Industry in 1939 and, under Jim’s direction since 1975 was a leader in Innovation, growing from 25,000 vehicles to become one of North America’s premier fleet management providers with over 300,000 vehicles under management in North America and over 1 million vehicles in 40 countries in partnership with ALD. Jim has held leadership roles in Industry Organizations, has been keynote speaker at national conferences and has testified on behalf of the Industry before the US Congress, Federal Trade Commission, U. S. Treasury, and the Financial Accounting Standards Board.

Jim has a bachelor’s degree from Dartmouth College and an MBA from Stanford University. He is actively involved in Community affairs, serving on the Boards of: University of Chicago, Dartmouth College, Field Museum of Natural History, Illinois Network of Charter Schools, Teach for America, The Chicago Public Education Fund, Vice Chair of the University of Chicago Medical Center where he was recognized as an “Honorary Fellow of the Division of Biological Sciences, and Board Chair of Intrinsic Schools, a charter school network serving 2,000 students in Chicago.

Jim lives with his wife Karen in Winnetka, Illinois and Aspen, Colorado. They have three children, and five grandchildren.

Shruti Gandhi, is the founder of Array Ventures. Array Ventures is an enterprise data AI fund that invests at the pre-seed stage. She is based in Silicon Valley and has invested in over 75 companies in their pre-seed rounds which are now worth billions. Over last 9 years the fund has over 12 exits to companies such as Apple, Paypal, ServiceNow, Amazon, JAMF, and others generating. Array has 75 active investments across 3 funds. She is on Techcrunch 10 VCs that founders like list alongside investors from Greylock and First Round.

She is class of 2012 from Booth School of Business and has a Master’s in Computer Science from Columbia University.

Anu Hariharan is the Founder & Managing Partner of Avra. She was most recently the co-founder and Managing Director of Y Combinator’s Growth fund where she worked with several hundred growth stage founders. She led YC’s growth investments in Brex, Faire, Gusto, Whatnot among others. Prior to YC, Anu was a partner at Andreessen Horowitz where she worked with the management teams of Airbnb, Instacart, Udacity among others. Prior to that she started her career as a senior software engineer at Qualcomm. Anu has an MS in electrical engineering from Virginia Tech and an MBA from Wharton.

Mar Hershenson is a co-founder and Managing Partner at Pear VC, a seed-stage venture firm in Palo Alto backing companies like Guardant Health(NASDAQ: GH), Doordash (NYSE: DASH), Gusto, and Branch. Mar has been recognized in the Midas List of Top Tech Investors in 2021 and 2022.

After earning a PhD in Electrical Engineering from Stanford University, Mar developed a groundbreaking technique of optimizing the design of analog semiconductors. Since then, she has accrued over 13 years of founder experience, co-founding three startups in mobile/ecommerce, enterprise software and semiconductor industries and has registered 14 separate patents.

Mar has received many awards throughout her career. Among them, the renowned T35 Young Innovator Award by MIT (for her technical work), and the prestigious Marie R. Pistilli Women in EDA Achievement Award in 2010 (for her work in entrepreneurship).

Mar currently serves on the Board of Trustees of Harvey Mudd College and on the Advisory Council of the Electrical and Computer Engineering Department at Carnegie Mellon University. Mar is a founder of Equity Summit, the premier conference for connecting URM Venture Capital GPs to LPs, and an initial founding member of All Raise.

Mar is based in the Bay Area with her husband Matt and has three children. She is an avid runner!

Brent Hill is a partner at Origin Ventures, an early-stage venture capital firm focused on software, marketplace, and consumer companies. He serves on the board of directors of portfolio companies 15Five, Fountain, Blueboard, Measured, Tilt, Everee, Salad, Pronto, Voxpopme and Kidizen. He is a board observer for the firm’s investments in Cameo, Tracer, and ViralGains. Other previous investments include Grubhub (NYSE: GRUB) , Tubemogul (acquired by NASD: ADBE), Ahalogy (acquired by NYSE: QUOT), Teem (acquired by WeWork), and Apptentive (acquired by Alchemer). Prior to joining Origin, Brent led sales organizations for Twitter, Google, and Feedburner. Before joining FeedBurner, he was the president of a national consumer services business, an entrepreneur-in-residence, and an EVP with a unit of Interactive Corp. He also co founded MVP.com, an early e-commerce business. Brent started his career with Accenture, where he spent 10 years developing CRM software for the telecom industry. He received a BS in finance from Bradley University and an MBA from Chicago Booth.

Alyssa Jaffee is a partner at 7wireVentures where she invests in companies that empower everyone to be better stewards of their health. She holds board roles at Caraway Health, NOCD, MedArrive, Brightline, Zerigo Health, and Jasper Health. Previously, Alyssa was an investor at Pritzker Group Venture Capital and Hyde Park Angels. Alyssa is also a cofounder of TransparentCareer, a NVC winning company helping people make more data-driven career decisions. Alyssa spent time at the Advisory Board Company where she launched new technologies and consulted hundreds of hospital executives to understand their needs and recommend solutions.

Alyssa attended the University of Wisconsin-Madison and received an MBA from Chicago Booth. Her work and accomplishments have been featured in Fortune, Stat News, MedCity News, Crain’s, and more.

Van is a Deal Lead at Wellington Access Ventures, a new dedicated early-stage venture capital fund within Wellington Management, a private, independent investment management firm with client assets under management totaling over US$1 trillion.

Van began his career in China, advising multinationals on strategy and growth across emerging markets. He co-founded Hello Tractor, an agricultural equipment SaaS platform that operates across Africa. Before joining Wellington, Van was a Partner at Drive Capital, the largest Midwest-based venture capital firm. While at Drive Capital, Van invested across verticals, focusing on fintech, enterprise SaaS, and cloud-based data infrastructure.

In 2018, Van was honored by the Chicago Booth community with the Chicago Booth Young Alumni Distinguished Alumni Award and currently sits on the Distinguished Alumni Awards Selection Committee. Van also serves as a Trustee of the University of Cincinnati Foundation and on the university’s Investment Committee. Van earned his bachelor’s degree from the University of Cincinnati and an MBA from the University of Chicago Booth School of Business. Van lives in Los Angeles with his wife Ashley, and son Harrison.

Venetia Kontogouris is the managing director of Venkon Group LLC, a company that invests in real estate and early stage ventures, with an emphasis on technology and cloud-based services. Current investments include Zumigo, Ruby Seven Studios, Flow Inc., Be Health, Energy Savvy, and Simple Mills. Prior to her employment with Venkon Group, Kontogouris was the senior managing director for Trident Capital, where she oversaw venture capital investing. She was one of the original members and co-managing partner for Funds IV, V, and VI with over $1.5 billion of venture investments under management. During her time at Trident Capital, she was responsible for many successful investments and exits including, Odyssey Logistics, Outsource Partners International, Microland, Advantec, Infotrieve, Sphere, Viant, Daou Systems, Vality, PBN/Taleo, IPro, Invention Machine, and CrossMedia.

Mark Koulogeorge is managing general partner of MK Capital where he leads the firm’s digital marketing and software investment practices and has over eighteen years of venture capital experience. Mark’s functional expertise is in developing sales, marketing and distribution strategies to achieve market leadership and in the building of high performance executive teams.

Prior to founding MK Capital, Mark was a managing director at First Analysis and served as a general partner of The Productivity Fund III & The Productivity Fund IV. Prior to his career in venture capital, Mr. Koulogeorge was an Executive Officer of Eagle Industries, a $1.5 billion diversified manufacturer, controlled by Chicago entrepreneur Sam Zell and earlier a consultant with Booz Allen. He earned a BA from Dartmouth College and an MBA from Stanford University.

Mark is a partner in the startup and venture capital group of Fenwick & West. He advises technology and life science companies, including those focused in the software, telecommunications, and semiconductor sectors. His practice includes startup counseling, venture capital financings, public offerings, corporate governance, mergers and acquisitions, and joint ventures. Mark represents companies in varying stages, ranging from privately-held startups to publicly-traded companies. Earlier in his career, Mark worked as an engineer. He received a BS in industrial engineering from Stanford University and a JD/MBA from the University of Chicago.

Allison is a partner at Hyde Park Venture Partners and has been with the firm since 2019.

Prior to HPVP, Allison ran business operations for Civis Analytics, a Chicago-based data science software startup. She also co-founded Flag Analytics, a predictive analytics company focused on public safety, and spent her early career in healthcare consulting at Accenture. Allison has led and manages HPVP’s investments in Certiverse, CoPilot, and FactoryFix, among others.

Matt McCall is the Founding Partner, FORGE Capital, Investment Chair at FMC/CCI (Crown Family venture arm), and was formerly a partner at Pritzker Group Venture Capital and a founding partner with DFJ Portage. He is the author of the popular blog, SomethingVentured.com.

Over his 28+ years in the business, he has backed over 80 companies, completed more than 500 financings and evaluation over 20,000 business plans. He has had over $80B in enterprise exit value. He also has a strong interest studying the drivers & derailers to high performing cultures and sustainable entrepreneurial success. He is certified in an array of leadership and coaching programs.

McCall has been involved with investments including: DollarShaveClub (acquired by Unilever), Coinbase (IPO), Honest Company (IPO), Tock (acquired by SquareSpace), SMS-Assist (acquired by Lessen), P44, Facebook (IPO), Mapbox, Tovala, Feedburner (acquired by Google), PlutoTV (acquired by Viacom), Graphiq (acquired by Amazon), Lefthand Networks (acquired by HP), Performics (acquired by Doubleclick/Google), AwesomenessTV (acquired by DreamWorks), Playdom (acquired by Disney) and TicketsNow (acquired by Ticketmaster).

McCall has taught courses or lectured on Entrepreneurship at Kellogg, Booth/UoC, USC, UCLA, University of Denver and CU Boulder. He has been honored on Crain’s annual “40 under 40”, Crain’s top Tech 25 list, the Re/code top 30 tech power list, a Top 100 VC, a Media 100 and a Hollywood 100 Power Player. He has keynoted or been a panelist at over 125 conferences and events nationwide. He is the founder & trustee of the McCall Family Foundation, focused on encouraging social entrepreneurship and global human/girls’s rights. He has served on numerous regional high technology advisory boards.

Previously, McCall worked in the Boston Consulting Group’s Chicago office, where he managed consulting and client teams on projects in the retail, health-care and financial services industries.

McCall holds a B.A. in Economics and History from Williams College and an MBA with honors from Northwestern University’s J.L. Kellogg Graduate School of Management. He also holds a Masters in Manufacturing Management from Northwestern University’s McCormick School of Engineering.

Bob is the founder and managing partner of Annox Capital Management, a private firm that focuses on early-stage to mid-stage venture investing. Prior to founding Annox, he held positions within Booking Holdings, Inc., including CFO, head of worldwide strategy and planning, and vice chairman. He played a major role in transforming Booking Holdings into one of the most profitable and valuable e-commerce companies in the world. Bob began his career at Merrill Lynch Capital Partners, the private equity investment arm of Merrill Lynch & Co. He has expertise in identifying innovative, industry-shaping companies and guiding them to broader global implementation. He serves on the board of directors of several innovative public companies including Booking Holdings, Inc. (NASDAQ: BKNG), Dropbox, Inc. (NASDAQ: DBX), and Redfin Corp. (NASDAQ: RDFN). He also serves on the boards of directors of many other private companies in which Annox has made investments, including ClassPass, Evolve Vacation Rentals, Freightos, Sakara Life and Vroom. Bob holds a BA from the University of Michigan and an MBA from Chicago Booth.

Koichiro “Koh” Nakamura has led numerous investments including Coinbase, Palantir, and Square. He is also actively involved with Zoom, Fastly, Insightly, One Concern, Chainalysis, and Clearbanc among others. Koh, a Waseda University Law and Chicago Booth MBA graduate and two times finalist of NVC, was a member of Kauffman Fellows Class 12, and was given the Jeff Timmons Memorial Award in recognition of his outstanding contributions to that program.

He was an early pioneer in Japan’s IT scene as a member of the founding team of Yahoo Japan, and led the seed investment into Scigineer. He co-founded Sozo Ventures in 2012 to guide globally ambitious founders looking to maximize Japan and Asian expansion opportunities. Koh, who says, “Iconic companies go global, and global markets go through Japan,” points to Palantir as the portfolio company that took the long-term view, which has rewarded them with a $150M joint-venture in Japan, and over $550M in the pre-IPO round from Japanese partners.

Koh, having shepherded hundreds of companies through international expansion, has shared his expertise in Nikkei, MarketWatch, Forbes Japan, Venture Capital Journal, Newspicks and many other publications.

Carter is a Managing Partner of OrbiMed, a $17 billion global healthcare-focused private investment firm. Since joining the firm in 2002, Carter has led OrbiMed’s growth in several areas, including healthcare royalties and Asia private investments. He was previously a Director in the UBS Alternative Investments Group and spent four years in the investment management division of First Chicago (now part of J.P. Morgan). Carter received an M.B.A. in Finance from the University of Chicago and his CFA charter in 1995. He also received a B.A. in Economics from Emory University and a C.E.P. from the Institute D’Etudes Politiques in Paris in 1991, although his French has atrophied quite a bit since then. Carter is a member of the Rockefeller University Council and the University of Chicago’s Harper Society.

Eric Pérez-Grovas is founding partner of Wollef, a VC Fund focused on LATAM early-stage internet companies, among its investments it has unicorns such as Jeeves, Kavak, Konfio, Loft and Nubank. Eric is also co-founder and president of the board of the Mexican Association of Online Sales (AMVO), which among other things, organizes the most relevant e-commerce event in Mexico: HotSale. He also serves as board member of Walmart of Mexico and Central America, Kinedu, Solvento and Nexu. Eric actively participates in nonprofits, serving as board member of CMR Foundation. Eric’s internet experience began in 1999 when he opened and managed Mercadolibre’s Mexican operations. He also worked in consulting at McKinsey & Co. and Bain & Co. and held management positions at Cemex and Satmex. Eric holds a BS in industrial engineering, summa cum laude, from the Tecnológico de Monterrey. He received an MBA and MPP from the Stanford Graduate School of Business, where he was elected co-president of the GSB Latin American Student Association and vice-president of the Mexican Student Association at Stanford. Eric is a Kauffman Fellow, Class 22.

Shyam Rao is seasoned entrepreneur, executive, investor and advisor for several startups in Silicon Valley. He is Founder & CEO of Tote.ai, a new stealth seed-funded startup headquartered in Redwood City, CA. Prior to Tote.ai, he was the Founder and CEO of Punchh, a market leading CRM platform focused on delivering one-to-one customer engagement through artificial intelligence, mobile-first expertise, and omnichannel communications for restaurants and retailers. Punchh was acquired for $500M in April 2021 by PAR Technologies (nyse:PAR).

Prior to founding Punchh, Shyam was the Vice President of Business Development at Prime Focus Limited, and on the Principal Investments Team at Merrill Lynch. Shyam started his career at Motorola in its CDMA and WiMAX divisions as a software engineer. Mr. Rao holds a Bachelor of Science in Computer Engineering from the University of Toronto and a MBA from the University of Chicago. He lives with his wife and two boys in the San Francisco Bay Area.

Jon is a partner and co-president of Valor and the fund manager for Valor Siren Ventures (VSV). He serves as a member of all Valor investment committees. Jon has over 20 years of experience in private equity investing. Jon’s responsibilities include fund management for VSV, as well as investment prospect generation, due diligence of potential investments, investment structuring and execution, and capital raising for both the growth fund and VSV. Jon oversees Valor’s growth fund operations team and Valor’s finance function.

Over the years, Jon has focused on investment opportunities in the food and retail technology sectors. Jon began this focus with Valor’s 2006 acquisition of Sizzling Platter. Currently, Jon is a director of several Valor growth fund and VSV portfolio companies, including Gopuff, Misfits Market, Fooda, Wow Bao, and Atmosphere.

Prior to Valor, Jon was part of MG Capital’s investment and portfolio team. During his tenure at MG Capital, Jon worked on acquisition teams focused on executing transactions in the electronic connector industry. Jon served in operational roles at MG Capital’s portfolio companies, including chief operating officer of Connector Service Corporation’s plating division, where he managed the business through 100% growth over a 12-month period. Jon also served as president of electronic plating service and chief operating officer for Amax Plating, Electronic Plating Service, and Associated Plating Company. Prior to joining MG Capital, Jon worked with Bain & Company as an associate consultant. At Bain, he worked on assignments for various Fortune 500 clients in Texas and Australia.

Jon has served on the boards of directors of several charitable organizations, including the Pancreatic Cancer Action Network, the Chicago Children’s Museum, and he most recently co-founded Prosper Chicago. He is the former chair of the board of trustees for the Lycée Français de Chicago.

Jon holds a BBA in accounting (with honors) from the University of Texas at Austin.

Focus

David is the Co-Managing General Partner at Crosslink. He joined the firm in 2011 and focuses on venture investments in software, financial technologies and digital media.

Experience

David brings more than 20 years of experience working with technology businesses as a venture capital investor and investment banker. Prior to joining Crosslink, David was a partner at 3i Ventures, a global private equity and venture capital firm. He also served as a senior officer in the technology practices at both Robertson Stephens and Piper Jaffray. Some of his prior investments included: BlueLithium (acquired by Yahoo!), Demand Media (DMD), Fotolog (acquired by Hi-Media), Omniture (OMTR; acquired by Adobe), Speakeasy (acquired by BestBuy) and Vonage (VG).

Portfolio Companies

AutoFi, Arturo, BetterUp, Brace, Chime, Enigma, Great Jones, MarketDial, OnCue , Clyde and Weave

Select Prior Investments

Bizo (acquired by LinkedIn), BuildingConnected (acquired by AutoDesk), Casper (CSPR ), ServiceMax (acquired by GE), Vungle (acquired by Blackstone), BlueLithium (acquired by Yahoo!)*, Demand Media (DMD)*, Fotolog (acquired by Hi-Media)*, Omniture (OMTR; acquired by Adobe)*, Speakeasy (acquired by BestBuy)* and Vonage (VG)*

Education

BA, Dartmouth College

JD, Stanford University

* Investments made prior to joining Crosslink

Pete Wilkins is a Purpose First leader committed to creating a positive impact on the world.

Before he was thirty, he was a critical part of two technology startups that sold and IPO-ed for more than $2.8 billion. He later went on to lead the turnaround of a medical education company from record losses to record profits and build one of the premier online physician education communities, which he followed by starting a double-bottom-line company focused on college attainment for Latino families. Not every step was successful, but they were all purposeful.

Today, Pete leads HPA—one of the most successful early-stage venture investor groups in the country. He and his firm have partnered with hundreds of founders to help turn their dreams into reality, helping them scale their businesses from start-ups into industry leaders, many of which have gone on to join the exclusive “Unicorn Club.” As a venture investor, board member, and advisor to many entrepreneurs, Pete has created billions of dollars of economic value, but more importantly, he has helped countless founders manifest their purposes into thriving businesses that are improving the world.

In his first book, Purpose First Entrepreneur, Pete draws on a lifetime of lessons and research into value-driven principles and proven methodologies, plus the vast insights he’s garnered from working with and investing in some of the world’s most successful entrepreneurs. The book and online resources offer a new approach to help entrepreneurs discover their purpose, turn it into a thriving Purpose First Business, and harness it to perform at an elite level in all aspects of their lives.

In the spirit of giving back, Pete shares his perspective and insights about investing in companies and people as a Forbes contributor. He is also passionate about building Chicago’s entrepreneurial community and is actively engaged in World Business Chicago Leadership Council, Future Founders, and P33, a bold initiative to make Chicago a global technology leader. In recognition of his contributions, Pete has been named one of the Top 100 Chicago Innovators by the Chicago Tribune, was recognized as an “Innovation Blazer” by Chicago Inno, and won the Illinois Technology Association CityLIGHTS Industry Champion Award and the Chicago Innovation Award.

Gale Wilkinson is the founder and Managing Partner at VITALIZE, a seed fund and angel community investing in transformative work-tech software. Previously, Wilkinson founded IrishAngels, one of the largest angel groups in the world. Gale has led $70M+ in early-stage deals across 125+ portfolio companies, and she has made 50 personal angel investments. Her experience prior to VC includes founding two HR tech startups, consulting for new product launches with Nielsen, and data strategy with Orbitz.

Wilkinson received a BBA with honors from Notre Dame and an MBA with honors from the University of Chicago Booth School of Business. She is a founding Board member of Chicago: Blend, an organization focused on increasing diversity in VC and startups in Chicago.

She likes public speaking, design, and being a connector. Her inspirations include energy work, vintage and antique pieces, animals (especially horses and dogs), and nature. You can find her on X @galeforceVC. She lives in Chicago and Nashville with her husband and two dogs.

Sam Yagan serves as Founder and CEO of Fifth Star, Inc., a holding company of consumer and consumer-adjacent technology companies, and Co-Founder and Managing Director of Corazon Capital, an early stage venture capital firm. He recently served as the Chief Executive Officer of ShopRunner, Inc., an ecommerce enablement platform; in 2020, he led the sale of ShopRunner to FedEx Corp. (NYSE: FDX). Prior to ShopRunner, Sam served as Vice-Chairman of Match Group (Nasdaq: MTCH), a position he assumed after leading the company as Chief Executive Officer through a period of explosive growth that culminated in its IPO in 2015. Sam chairs the Boards of SpotHero and Voltage Park and recently served as a lead director of Grindr, Inc., guiding the company through its IPO in 2022.

Sam’s prior entrepreneurial ventures in the consumer internet sector include SparkNotes (founded in 1999), still the dominant brand of study guides, and eDonkey (founded in 2002), once the largest peer-to-peer file-sharing network in the world. He sold SparkNotes to iTurf, Inc. and then to Barnes & Noble, Inc., where he served as Vice-President and Publisher and oversaw the expansion of the digitally native brand into an expansive multi-platform media business. He also co-founded OkCupid, which he led as its CEO through its sale to Match Group in 2011. Under his leadership, Match Group incubated and launched Tinder, one of the most successful native mobile apps of all time.

Outside of work, Sam devotes himself to mentoring technology entrepreneurs and civic leaders. In 2009, he co-founded Excelerate Labs (now TechStars Chicago), a leading start-up accelerator, and served as its first Chief Executive Officer. Sam sits on the board of several private companies, including Brilliant Worldwide.. He also advises several venture capital funds, including Hyde Park Venture Partners and the FireStarter Fund, which he co-founded. He has served on Target Corp’s Digital Advisory Council, the Stanford Graduate School of Business Management Board, the board of Chamberlain Group, and as an advisor to Procter & Gamble. He also sits on the boards of nonprofits Start Early and the Rush University Medical Center.

Sam has earned recognition on TIME Magazine’s “100 Most Influential People in the World,” Fortune Magazine‘s “40 Under 40,” Crain’s Chicago “Tech 50″ and “40 Under 40”, Billboard Magazine’s ”30 Under 30,” D Magazine’s “Dallas 500” and ranked #19 on Silicon Alley Insider’s “Most Inspiring and Influential People.” He has received the Chicago Innovation Awards’ “Visionary of the Year Award,” IMSA’s “Distinguished Leadership Award,” the DCIA’s “Pioneer’s Award,” and admission to Chicago Innovation’s Hall of Fame. Sam has testified before the United States Senate Judiciary Committee and has spoken at the CATO Institute, Digital Hollywood, IRCE, the Federal Trade Commission, and numerous other industry events. Sam has a BA with honors in Applied Mathematics and Economics from Harvard College and an MBA from the Stanford Graduate School of Business, where he earned distinction as a Siebel Scholar, an Arjay Miller Scholar, and the Henry Ford Scholar, the award granted to each class’s valedictorian. Sam lives in Chicago with his wife, Jessica, and three kids, Maggie, Jack, and Max.

Edward L. Kaplan, ’71

Rattan L. Khosa, ’79

Jim and Karen Frank

Venetia Kontogouris, MBA ’77

Gregory J. Purcell, ’94, and Francine C. Purcell

Robert Vishny and Keren Rutberg Vishny, MD ’89

Colleen and David* Kessenich, MBA ’96 (*deceased)

Mark Leavitt and Enlightened Hospitality Investments

Mark Leavitt and Enlightened Hospitality Investments

Robin Loewenberg Tebbe and Mark Tebbe

Carol Rubin and Steven Kaplan

Teed J. Welch and Susan Brenner Fund for Entrepreneurship

This site uses cookies and other tracking technologies to assist with navigation and your ability to provide feedback, analyze your use of products and services, assist with our promotional and marketing efforts.